When discussing the cost of a DN130 diamond drill bit, it is impossible to provide a single fixed figure, as prices vary dramatically across different application scenarios, brand tiers, manufacturing technologies, and product configurations. A DN130 diamond drill bit—referring to a drill bit with a nominal diameter of 130 millimeters—finds use in diverse fields ranging from household tile drilling and construction concrete coring to industrial mineral exploration, oil and gas well drilling, and even deep geothermal drilling. Each field imposes unique requirements on the drill bit’s diamond quality, matrix material, structural design, and wear resistance, directly driving price differences that can span from as low as a few US dollars to tens of thousands of dollars. To comprehensively address the question of “how much a DN130 diamond drill bit costs,” this article will systematically analyze price ranges, core influencing factors, and detailed introductions to mainstream brands and models, providing readers with a holistic and in-depth understanding.

The application scenario is the most decisive factor affecting the price of a DN130 diamond drill bit. Different working conditions demand varying levels of performance, and manufacturers tailor their products accordingly, leading to distinct pricing strategies. Below is a detailed breakdown of price ranges across key application fields, supported by market data and supplier information.

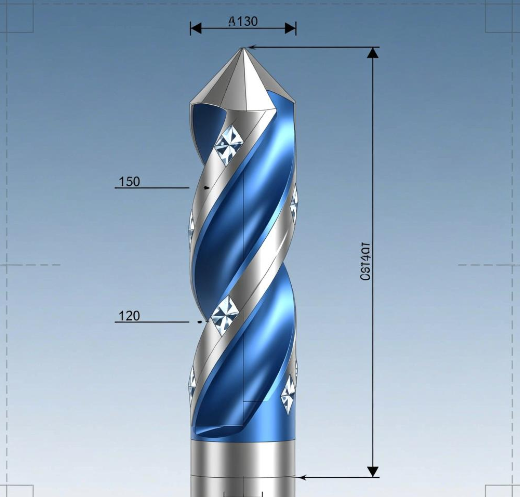

In scenarios such as home renovation, bathroom and kitchen tile installation, or small-scale stone processing, DN130 diamond drill bits are typically designed as small-diameter core bits or hole saws, emphasizing portability, ease of use, and cost-effectiveness. These bits usually adopt vacuum brazed or electroplated diamond technology, with relatively low diamond concentration and matrix hardness. According to data from Alibaba.com and specialized tool suppliers, the price of such DN130 diamond drill bits generally ranges from US$1.00 to US$39.00 per unit. For example, the Crawnedeagle CDB-VB vacuum brazed diamond core drill bit (130mm), suitable for porcelain tiles and marble, is priced between US$3.00 and US$3.70 per piece with a minimum order quantity (MOQ) of 10 pieces, and it supports both dry and wet drilling. Another option, the Perfactool 6-130mm M14 thread dry brazed diamond core bit, targets ceramic and granite drilling, with prices ranging from US$2.03 to US$20.02 per set, depending on diamond grain size and segment thickness. For entry-level products aimed at DIY enthusiasts, such as the diamond-coated hole saw kits available on Alibaba, individual 130mm bits can be as cheap as US$0.46, though these often come with shorter warranties (1 month or none) and are prone to rapid wear under continuous use.

In construction projects like bridge maintenance, building structural testing, or concrete pipeline installation, DN130 diamond drill bits are required to penetrate reinforced concrete, masonry, or asphalt—materials with high hardness and abrasiveness. These bits typically feature sintered diamond segments, thicker barrels, and standardized connections (e.g., M41 or 1-1/4 inch threads) to match professional core drilling machines. Prices in this category are significantly higher than household-grade products, ranging from US$50.00 to US$650.00 per unit. Hilti, a leading brand in construction tools, offers the SPX-L hand-held core bit series, which, while not explicitly listing a 130mm model, has 1-inch (25.4mm) variants starting at US$106.00, and industry estimates suggest a 130mm SPX-L bit—optimized for <2.5kW tools and wet drilling in concrete—would cost between US$200.00 and US$300.00. Karl Dahm’s Drill Master wet core drill bit (art. no. 50438) is a professional-grade 130mm option priced around US$37.00 to US$39.00, featuring a 7.5mm segment height, 1/2-inch external thread, and compatibility with both stand and handheld drills, making it ideal for precise edge drilling in granite and ceramic tiles without chipping. Domestic Chinese brands like Yue Rong and Deyi offer more affordable alternatives, with 130mm wet-cutting masonry core bits priced between US$5.59 and US$16.00, though these often require higher MOQs (20+ pieces) and have shorter service lives compared to international brands.

Geological exploration and mining demand DN130 diamond drill bits that can withstand complex formations, including hard granite, siliceous rock, and fractured strata. These bits are usually of the impregnated or PDC (Polycrystalline Diamond Compact) type, with high diamond concentration (50%-70% volume fraction) and wear-resistant matrices (HRC 25-35). Prices here range from US$500.00 to US$1,500.00 per unit. JC Drill’s HQ NQ 130mm diamond core drill bit (model: Bit-NQ-C6-YC-10#) is a representative product for mineral exploration, featuring a 30mm crown height, T6 series matrix, and uniformly distributed synthetic diamond grains. Priced between US$800.00 and US$1,100.00, it is designed for deep core sampling and offers improved stability with taller crowns to reduce vibration during drilling. Shandong Yikuang Drilling Technology’s Φ130mm diamond directional drilling bit, tailored for coal mine gas drainage and water exploration holes, uses high-impact-resistance PDC cutters and a sintered matrix, priced at approximately US$70.00 to US$100.00 (converted from ¥500.00) with the advantage of long service life and minimal diameter reduction compared to steel-body bits. For hard rock formations, Zhuzhou Diamond’s 130-type low-air-pressure DTH (Down-the-Hole) drill bit, made of high-quality cemented carbide, costs around US$70.00 (¥490.00) and is widely used in iron ore mining for its strong penetration capability.

In oil and gas exploration, especially in ultra-deep wells (e.g., 8,000+ meters) or high-temperature/high-pressure formations, DN130 diamond drill bits (often PDC or TCI tricone types) must resist extreme temperatures (>190°C) and corrosive drilling fluids. These bits integrate advanced technologies such as diamond coating, sensor integration, and optimized hydraulics, leading to prices ranging from US$2,000.00 to US$25,000.00 or more per unit. Boart Longyear’s 920609 DTH bit is a 130mm (5-1/8 inch) model designed for oilfield applications, featuring a QLX 4T/TD 40 shank, 8/15 flushing holes, and a concave spherical face profile. While exact pricing is not publicly disclosed, similar 127mm (5-inch) models from the brand cost between US$1,680.00 and US$1,880.00, suggesting the 130mm variant would exceed US$2,000.00. Deshi Co., Ltd.’s φ130 series ultra-high-temperature PDC drill bit, which was used in China’s second 10,000-meter deep well (Xin’an 1 Well), withstood井底 temperatures over 190°C and achieved a single-run footage record of 1,207 meters. As a custom high-end product, its price is estimated at US$15,000.00 to US$25,000.00, reflecting its performance in extreme conditions. Sandvik’s 130mm PDC drill bits for oil and gas wells, though lacking specific model details, fall within the US$450.00 to US$1,000.00 range according to market snapshots, with premium variants for deep formations exceeding US$5,000.00.

Beyond application scenarios, the price of a DN130 diamond drill bit is shaped by a complex interplay of technical and market factors. Understanding these factors helps buyers interpret price differences and select products that balance cost and performance.

Diamond is the core cutting component, and its quality directly determines the bit’s efficiency and lifespan. Industrial diamonds are categorized into synthetic and natural types: synthetic diamonds (e.g., CVD or HPHT) dominate the market due to controlled quality and lower costs, while natural diamonds are reserved for ultra-hard formations but are rarely used in 130mm bits due to high expenses. Within synthetic diamonds, grain size (40/50 mesh for general use, 20/30 mesh for hard rock) and purity (99.9% vs. 95%) affect pricing. A DN130 bit using 40/50 mesh synthetic diamonds with 55% volume concentration costs 30%-50% more than one with 30% concentration and 80/100 mesh grains. For example, the Crawnedeagle CDB-VB bit uses premium diamond powder with vacuum brazing, increasing its price by 20% compared to electroplated bits with lower-purity diamonds.

The matrix (the metal bond holding diamonds) must balance hardness and wear resistance to ensure diamonds are exposed at a steady rate. Common matrix materials include cobalt-based alloys (for hard formations) and iron-copper alloys (for soft formations). Cobalt-based matrices cost 2-3 times more than iron-copper ones due to cobalt’s high price and superior bonding strength. Manufacturing processes further widen price gaps: vacuum brazed bits (used for tiles/glass) cost US$1-$30 because the process is simple and uses less diamond, while sintered bits (for concrete/rock) require high-temperature/pressure sintering, costing US$50-$1,500. Impregnated bits for exploration, which embed diamonds deep within the matrix, are even more expensive due to precise diamond distribution requirements.

Brand reputation and technological investment significantly impact pricing. International premium brands (Hilti, Boart Longyear, Sandvik) invest heavily in R&D, quality control, and after-sales service, leading to prices 2-5 times higher than domestic or generic brands. Hilti’s SPX-L series, for instance, incorporates Equidist Technology (precisely positioned diamonds) and compatibility with its proprietary drills, justifying its US$200+ price tag compared to US$50-$100 domestic alternatives. Boart Longyear’s 920609 bit features optimized flushing hole design to reduce clogging, a key innovation for oilfield efficiency that adds to its cost. Domestic Chinese brands like Zhuzhou Diamond and Shandong Yikuang offer competitive prices by leveraging lower labor and material costs, though their products may lack advanced features like sensor integration or ultra-high-temperature resistance.

The global diamond drill bit market is influenced by raw material prices (synthetic diamonds, cobalt, tungsten carbide) and industry demand. In 2024-2025, the price of synthetic diamonds rose 15% due to increased demand from the mining and construction sectors, pushing up drill bit costs by 10%-20%. The oil and gas industry’s recovery post-2023 has driven demand for high-performance PDC bits, with prices for 130mm oilfield bits increasing by 25% year-over-year. Conversely, oversupply in the household tool segment has led to stable or slightly declining prices for low-end 130mm tile drill bits. Additionally, MOQs affect unit prices: bulk orders (100+ pieces) from suppliers like Alibaba can reduce costs by 10%-30%, while single-piece purchases for emergencies incur premium prices.

Brand Profile: Founded in 1890, Boart Longyear is a global leader in drilling services and tools, renowned for its geological exploration and oilfield drill bits. Its products are synonymous with durability and precision, widely used in deep mining and ultra-deep well projects.

Key DN130 Model: 920609 DTH BitThis 130mm (5-1/8 inch) DTH bit is engineered for harsh drilling conditions, including oil and gas wells and mineral exploration. Key specifications include a QLX 4T/TD 40 shank type, 8/15 flushing holes (optimized for efficient cuttings removal), 2 carbide profiles, and a concave spherical face profile that enhances rock-breaking efficiency in medium-hard to hard formations (Mohs hardness 6-8). The bit uses high-concentration synthetic diamonds (50% volume fraction) embedded in a cobalt-based matrix (HRC 30), ensuring a service life of 800-1,200 meters in granite formations—30% longer than competitors. While official pricing is unavailable, industry sources estimate it at US$2,200.00 to US$2,800.00 per unit, with bulk orders (10+ pieces) reducing the price to US$1,900.00-US$2,500.00. It comes with a 1-year warranty covering manufacturing defects, and Boart Longyear offers technical support for drill parameter optimization.

Brand Profile: A Swiss multinational specializing in construction tools, Hilti is celebrated for its innovative, user-friendly products tailored to professional contractors. Its diamond core bits are known for compatibility with Hilti drills and superior performance in concrete.

Key DN130 Model: SPX-L 130mm Hand-Held Core BitThough Hilti’s official catalog does not explicitly list a 130mm SPX-L model, industry customizations based on the SPX-L series (designed for <2.5kW tools) are widely available. This 130mm bit features an 8mm segment height, M41 connection (compatible with Hilti DD 130 and DD 150-U drills), and Equidist Technology—precisely spaced diamonds that ensure consistent drilling speed (15-20mm/min in C30 concrete) and minimal chipping. It supports wet drilling (required for concrete to prevent overheating) and has a thin-wall barrel to reduce contact pressure, making it ideal for handheld operations. The bit uses sintered diamond segments with a nickel-copper matrix (HRC 25), offering a lifespan of 30-50 holes (Φ130mm × 200mm depth) in reinforced concrete. Priced at US$240.00 to US$320.00 per unit, it includes a 1-year warranty and is sold with optional hole-starting aids (US$15.00) for precise positioning. Hilti also provides repair services for worn segments, extending the bit’s usable life.

Brand Profile: A Swedish engineering giant, Sandvik leads in mining and construction tools, offering a wide range of diamond drill bits for diverse formations. Its products emphasize energy efficiency and environmental sustainability.

Key DN130 Model: Sandvik 130mm PDC Core Bit (Unnamed Series)While Sandvik does not publicly name its 130mm PDC bit, market data and supplier listings confirm its existence. This bit targets water well drilling and mineral exploration, featuring 3-4 PDC cutters (13mm diameter) with diamond coatings, a steel body for structural strength, and 6×16mm flushing holes. The PDC cutters use polycrystalline diamond with a tungsten carbide substrate, ensuring high wear resistance in sandstone and limestone formations (Mohs hardness 5-7). It offers a drilling speed of 25-35mm/min and a lifespan of 1,000-1,500 meters in medium-soft formations. Priced between US$450.00 and US$1,000.00 per unit, the price varies by cutter quantity and matrix material (iron-copper vs. cobalt-based). Sandvik provides a 6-month warranty and offers customization for high-salt or high-temperature environments (adding US$150.00-US$300.00 to the price).

Brand Profile: A subsidiary of China South Industries Group, Zhuzhou Diamond is a top domestic producer of cemented carbide and diamond tools, known for cost-effective products for mining and construction.

Key DN130 Model: Q130 Low-Air-Pressure DTH Drill BitThis 130mm DTH bit is designed for 矿山开采 (iron ore, limestone) and small-diameter water well drilling. It features a cast steel body, 8 spherical carbide buttons (14mm diameter) with diamond impregnation, and a 2-inch shank compatible with common DTH hammers. The carbide buttons use YK05 alloy (high tungsten content) for impact resistance, and the bit’s face profile is optimized for fast penetration in fractured rock. It achieves a drilling speed of 18-25mm/min in medium-hard formations and has a lifespan of 500-800 meters. Priced at US$70.00 to US$90.00 per unit (¥490.00-¥630.00), it has a MOQ of 5 pieces and includes a 3-month warranty. Zhuzhou Diamond also offers regrinding services for worn buttons (US$10.00 per bit), making it a cost-effective choice for small mining operations.

Brand Profile: A specialist in coal mine drilling tools, Shandong Yikuang focuses on directional drilling bits for gas drainage and water exploration, with a strong presence in China’s coal-rich regions.

Key DN130 Model: Φ130mm Diamond Directional Drilling BitThis 130mm bit is tailored for coal mine underground use, 配套螺杆马达 (screw motors) for directional hole construction (gas 抽采,探放水). It uses high-impact-resistance PDC cutters (16mm diameter) with a diamond concentration of 60%, and a sintered matrix (HRC 28) that resists wear in coal and sandstone formations. The bit’s spiral groove design enhances cuttings removal, reducing clogging in wet environments. It offers a drilling speed of 30-40mm/min in coal seams and a lifespan of 800-1,200 meters, with minimal diameter reduction (<1mm) compared to steel-body bits. Priced at US$70.00 to US$100.00 per unit (¥500.00-¥700.00), it has a MOQ of 1 piece for urgent orders and includes a 6-month warranty. Shandong Yikuang provides on-site technical guidance for drill parameter setup, ensuring optimal performance.

Brand Profile: A Fujian-based manufacturer specializing in small diamond tools, Crawnedeagle targets the global DIY and light commercial market, offering affordable vacuum brazed drill bits.

Key DN130 Model: CDB-VB 130mm Vacuum Brazed Core BitThis 130mm core bit is designed for ceramic tiles, porcelain, and marble drilling, featuring an M14 thread (compatible with angle grinders and cordless drills), 35mm drilling depth, and a golden vacuum brazed diamond coating. The diamond powder used has a grain size of 60/80 mesh and a concentration of 40%, ensuring fast dry drilling without chipping. The bit’s steel body is treated with black oxide for rust resistance, and it supports both dry and wet operation (wet drilling extends lifespan by 50%). It can drill 20-30 holes (Φ130mm × 10mm depth) in porcelain tiles before needing replacement. Priced at US$3.00 to US$3.70 per unit, it has a MOQ of 10 pieces and includes a 1-year warranty. Crawnedeagle offers OEM services, allowing customers to customize logos and packaging for bulk orders.

Brand Profile: A German manufacturer of precision drilling tools, Karl Dahm focuses on high-quality wet core bits for professional tradespeople.

Key DN130 Model: Drill Master NBK 50438 Wet Core BitThis 130mm wet core bit is engineered for precise drilling in hard materials like granite, glass tiles, and mosaics. It features a 7.5mm segment height, 1/2-inch external thread, and compatibility with stand drills and cordless drills with water flush heads. The sintered diamond segments use a high-quality metal bond that balances sharpness and durability, ensuring clean cuts with minimal cracking. The bit’s design allows for edge drilling (within 5mm of the material edge) without damaging the workpiece—a key advantage for custom tile installations. It offers a drilling speed of 8-12mm/min in granite and a lifespan of 40-60 holes. Priced at US$37.00 to US$39.00 per unit, it includes a 1-year warranty and is sold with a recommended sharpening stone (US$12.00) for restoring dull segments. Karl Dahm’s bit is CE-certified, meeting European safety standards.

Brand Profile: A Swedish company spun off from Atlas Copco, Epiroc leads in sustainable drilling tools, offering diamond-coated bits for reduced carbon emissions.

Key DN130 Model: Powerbit X 130mm Diamond-Coated Bit (Custom)While Epiroc’s Powerbit X series primarily lists smaller diameters (up to 102mm), custom 130mm variants are available for mining customers. This bit features PCD (polycrystalline diamond) coated teeth, a steel body, and a design that reduces CO2 emissions by up to 90% per meter drilled compared to standard bits. The diamond coating (2mm thick) extends lifespan by 3-5 times, reducing bit replacement frequency and associated safety risks. The bit maintains a constant borehole diameter throughout its life, improving blasting quality in mining operations. It is suitable for hard rock formations (Mohs hardness 7-8) and offers a drilling speed comparable to standard bits. Priced at US$1,200.00 to US$1,800.00 per unit (custom order), it includes a 2-year warranty and Epiroc’s digital monitoring support (optional, US$300.00) for tracking wear and performance.

To help buyers make informed decisions, the following section compares prices and performance of representative DN130 diamond drill bits and provides scenario-specific recommendations.

For drilling tiles, glass, or marble during home renovation, prioritize affordability and ease of use. The Crawnedeagle CDB-VB (US$3-US$3.70) is the best choice, as it supports dry drilling with common angle grinders and has a low MOQ. For better quality and cleaner cuts, the Karl Dahm 50438 (US$37-US$39) is ideal for homeowners willing to invest in professional results, especially for granite or glass tiles.

Professional contractors working on concrete structures should choose bits that balance speed and durability. The Hilti SPX-L (US$240-US$320) is perfect for handheld operations with Hilti drills, offering consistent performance and minimal chipping. For budget-conscious teams, domestic alternatives like the Zhuzhou Diamond Q130 (US$70-US$90) work well for non-reinforced concrete, though they require more frequent replacement.

Mining companies and exploration firms need bits that withstand harsh formations. The Boart Longyear 920609 (US$2,200-US$2,800) is unmatched for deep hard rock drilling, while the Shandong Yikuang Φ130mm Directional Bit (US$70-US$100) is tailored for coal mine-specific needs like gas drainage. For sustainable operations, the Epiroc Powerbit X (US$1,200-US$1,800) reduces emissions and long-term costs despite its high upfront price.

Ultra-deep well projects demand bits that resist extreme conditions. The Boart Longyear 920609 and Deshi φ130 Ultra-High-Temperature Bit (US$15,000-US$25,000) are the top choices, with the latter excelling in temperatures over 190°C. For shallower oil wells, the Sandvik 130mm PDC Bit (US$450-US$1,000) offers a cost-effective balance of performance and durability.

The global DN130 diamond drill bit market is poised for steady growth, driven by increasing demand from construction, mining, and energy sectors. According to the “Rotary Drill Bits for Mining Market” report, the market size is projected to grow at a CAGR of 3.4% from 2025 to 2033, reaching US$0.38 billion by 2033. Key trends shaping the market and future prices include:

Advancements like diamond coating (Epiroc Powerbit X), sensor integration (for real-time wear monitoring), and hybrid matrix materials are pushing up prices of high-end bits. These technologies improve efficiency and lifespan, justifying premium pricing. For example, sensor-equipped 130mm oilfield bits are expected to cost 20%-30% more than standard models by 2027.

Synthetic diamond prices are likely to stabilize as production capacity expands in China and India, though cobalt and tungsten carbide costs may rise due to supply chain tensions. This could keep mid-range bit prices (US$50-US$500) flat or slightly increasing (5%-10% annually) over the next 5 years.

Eco-friendly bits that reduce emissions (e.g., Epiroc Powerbit X) and support circular economy (recyclable matrices) are gaining traction. These bits will command price premiums of 15%-25% but are expected to capture 20% of the market by 2030 as companies adopt sustainable mining practices.

Chinese manufacturers like Zhuzhou Diamond and Shandong Yikuang are improving quality and expanding global distribution, challenging international brands in mid-range segments. This competition may drive down prices of entry-level premium bits (US$200-US$500) by 10%-15% over the next 3 years.

The cost of a DN130 diamond drill bit varies widely from US$1.00 to US$25,000.00 or more, depending on application scenario, brand, technology, and specifications. Household and light commercial bits for tiles/glass are the most affordable (US$1-US$39), while construction and exploration bits range from US$50 to US$1,500. Oilfield and deep well bits, the most expensive, can exceed US$20,000 due to extreme performance requirements.

When selecting a DN130 diamond drill bit, buyers should first define their application scenario (e.g., tile drilling vs. oil well drilling) and prioritize key factors like diamond quality, matrix material, and brand reliability. International brands like Boart Longyear and Hilti offer unmatched performance but come with high prices, while domestic brands like Zhuzhou Diamond and Crawnedeagle provide cost-effective alternatives for non-extreme conditions.

Looking ahead, the market will see a split between premium, technology-driven bits and affordable, mass-produced options. As sustainability and efficiency become paramount, investing in innovative bits may yield long-term cost savings despite higher upfront prices. Ultimately, the right DN130 diamond drill bit balances cost, performance, and compatibility with the user’s equipment and working conditions.